Nvidia will report its Q1 FY2026 earnings after markets close Wednesday. While many focus on how U.S. export controls may affect its global chip sales, some experts say there’s a more critical metric: the GB200 NVL72 rollout.

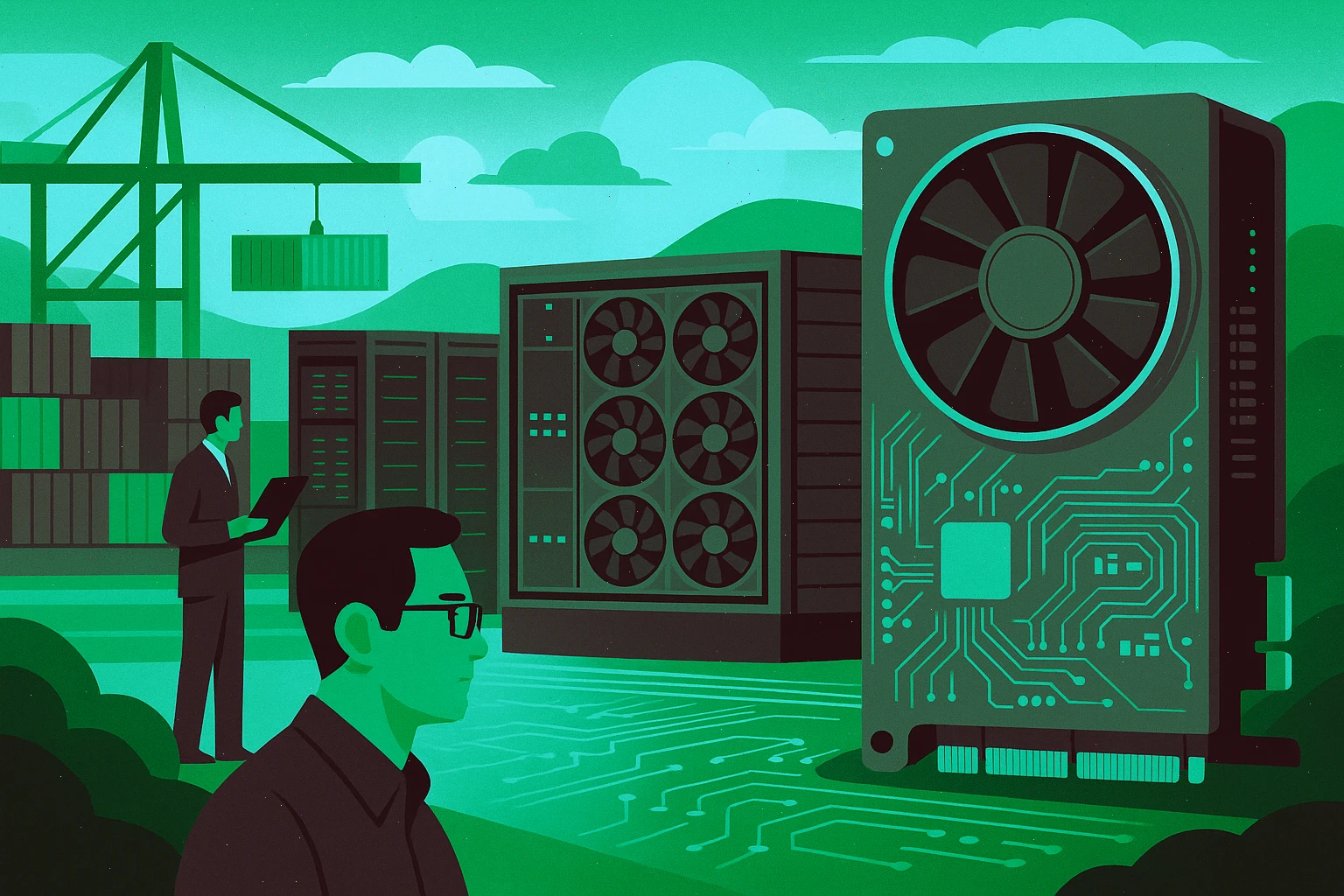

The Real Story: GB200 NVL72 Rollout

Zacks strategist Kevin Cook believes the spotlight should be on Nvidia’s new GB200 NVL72 system — a $3M, 72-GPU AI supercomputer. It started shipping in February, but visibility into shipments remains limited. Cook suggests that if CEO Jensen Huang announces delivery of 10,000 units in Q2, it could signal $30B in revenue. He expects less than half that number.

Enterprise Demand Is Key

This quarter offers early signs of whether businesses will upgrade AI systems regularly or take a more cautious approach — a factor critical to Nvidia’s long-term growth.

Export Restrictions: Less Impact Than Feared

Though U.S. export controls may cause short-term volatility, Cook argues they won’t significantly affect Nvidia’s performance. The company has proven resilient, rebounding quickly from policy-driven stock dips.

Global Demand Remains Strong

Nvidia continues to serve major hyperscalers and sees robust demand outside China, including projects like Stargate in the Middle East.

Bottom Line: Watch GB200 NVL72

Cook concludes that investors should focus on the trajectory of NVL72 shipments rather than short-term earnings. Steady or exceptional delivery figures would be a strong indicator for Nvidia’s outlook in 2025.